Introduction to vtmarkets

VTMarkets is a global multi -asset difference contract broker, which was established in 2015.It is mentioned that in the past articles of understanding Brother, it is mentioned that it is a securities firm that is on the "beauty lens", and it has a large area of publicity on many media channels on the domestic Internet.

At the same time, VTMARKETS has been continuously complained and reported in recent months. Among them, the activity turning rewards are deducted; some of the profits have been frozen for no reason and are frozen.Wait for a wonderful guest!It has attracted close attention to my brother!

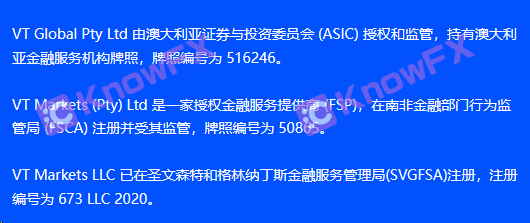

Regulatory license

In addition, the regulatory license held by Vtmarkets also attracted the attention of the brother, and its official website claims that he holds 3 regulatory licenses.

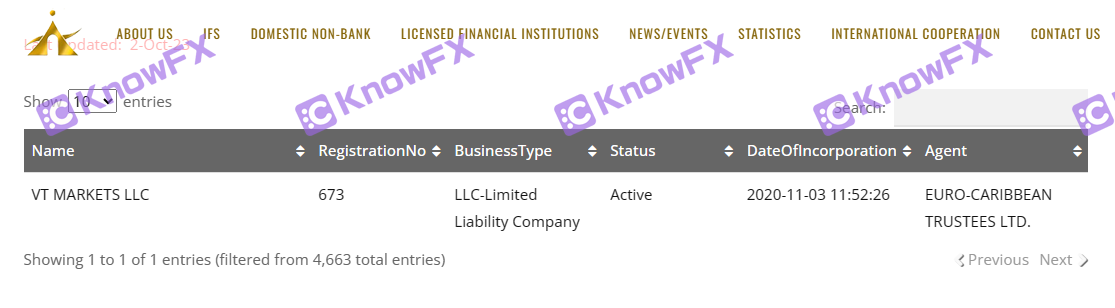

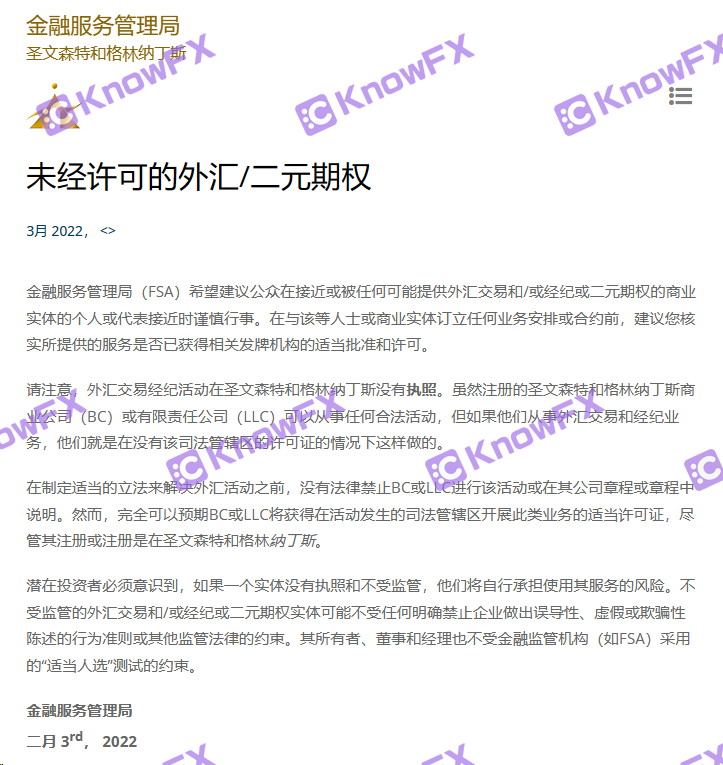

Saint Vincent and Grimadin Financial Service Administration SVGFSA

Among them, VTMARKETSLCCC, which is monitored by St. Vincent SVGFSA, has no need to say more!Earlier, I should pay attention to my brother. I should have been tired and crooked- "San Wendansa SVGFSA does not regulate foreign exchange and binary options."

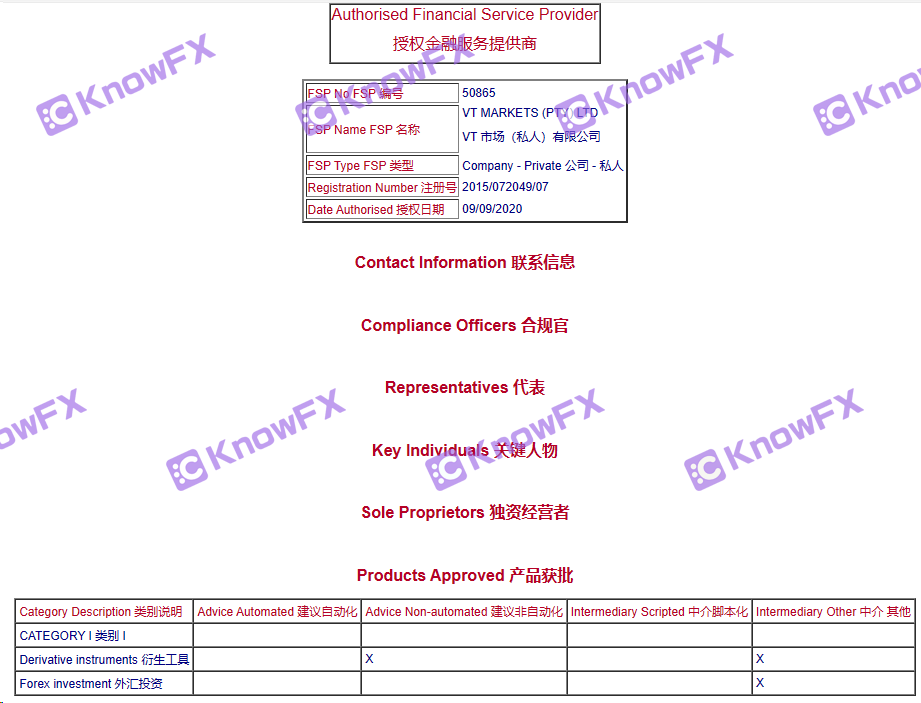

FSCA

The VTMARKETS (PTY) LTD was supervised by South Africa FSCA, but was only awarded the CategoryifSPS license and derivative tools and foreign exchange investment.It cannot be used for all trading markets.

In addition, the regulatory agency's resources and human resources are limited, and decision -making and procedures may lack transparency, resulting in their regulatory decision -making or policies that are not enough to respond to the market problems or protect the interests of investors.This is also what Hui friends need to consider.

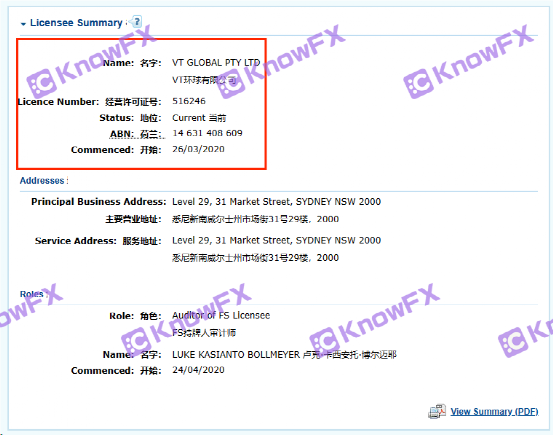

Australia Securities and Investment Commission ASIC

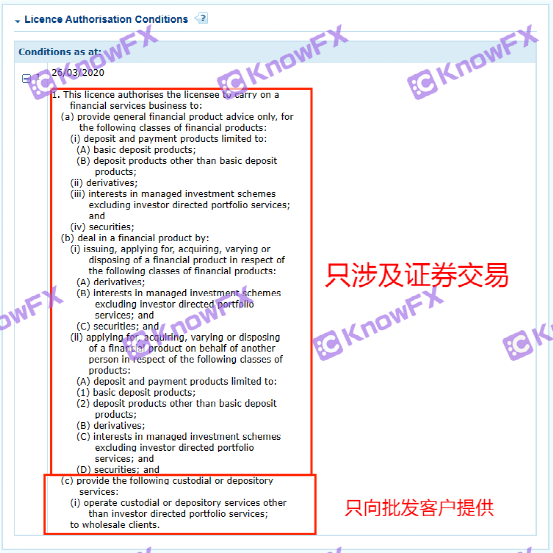

Finally, there are VTGLOBALOBALPTYLTD holding Australian ASIC licenses.However, I know that Brother has mentioned in the previous article that the license can only provide services to wholesale customers and have the right to retail.

At the same time, only the authority of securities transactions is given, that is, VTGLOBALPTYLTD except securities transactions, such as foreign exchange, commodities, and other transactions.

Trading and platform

And by comparison above!It can be seen that the market scope of VTMARKETS is quite extensive, but the three licenses they hold are more or less unable to touch places in terms of operating authority.This means that Huiyou may step into the pit of "over -limit operation" accidentally.

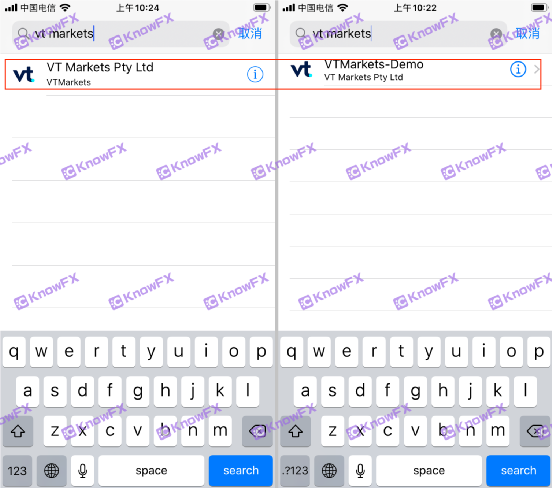

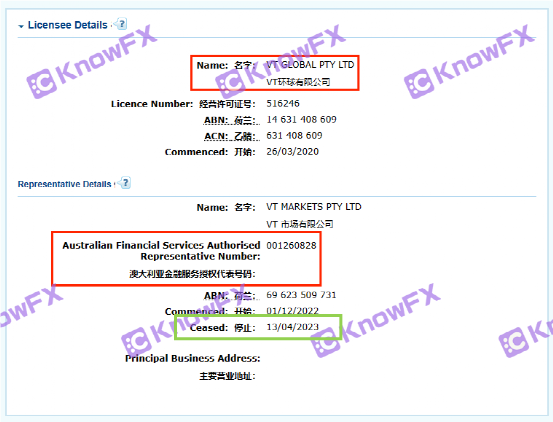

But obviously this is delusion!IntersectionBecause VTMarkets did not use any of the licensed companies for transactions at all.

VTMARKETS on its main transaction platform MT4 and MT5.The company holds the AR license plate of Australian ASIC!The awarded VTGLOBALPTYLTD mentioned earlier.And the authorization has expired as early as mid -April this year!

This means that since April this year, all transactions on the MT4/5 platform on VTMarkets are not protected by any supervision!And even if it is a previous transaction, as long as you are retail customers or transactions outside the securities are over -limited operations without supervision and protection!VTMarkets is really sinister!

VTMarkets, such as sugar and colorful black brokers wrapped in sugar coats and colorful!When I understand my heart, I sincerely remind everyone to face the publicity of the Internet and the benefits that are very tempting on the Internet.

If you want to know the secrets or complaints of more securities firms, you can add QQ: 3464399446.

Or enter the QQ group of Huiwei power: 762516501 (full)

Please add 3 group 868803834

Communicate together here, understand the latest developments in the industry, and avoid lightning on lightning on lightning up

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

近几年,货币行业越来越热,黑平台层出不穷,披着虚假金融衍生品的资金盘...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...