FOREXEXCHANGE freezes customer funds, and the Japanese FSA prohibits domestic brokers from providing services to non -national citizens!

Do everyone know which country the world's largest foreign exchange market is?!

The truth brother will not sell Guanzi here. The world's largest foreign exchange market is Japan.

That's right, not the United States, nor European countries, Japan, is it a little shocked!Intersection

Japan, the world's largest retail foreign exchange market, has created 35%to 40%of retail foreign exchange transactions in the world with less than 200 million people.

As a country with the largest foreign exchange transaction volume, is it safe to do transactions in the country?Intersection

The protagonist we want to talk about today is a foreign exchange platform in Japan ~

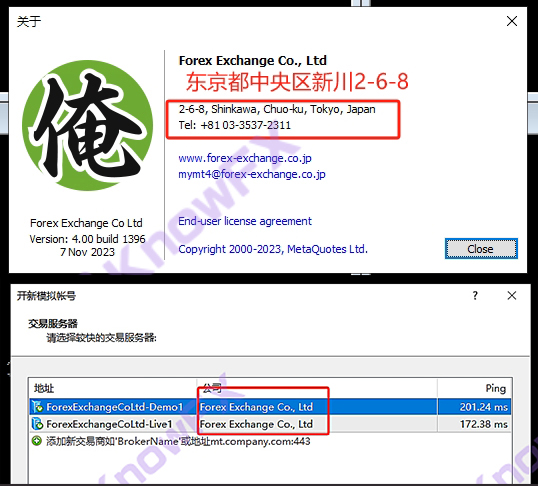

ForexexChange was established in 2004. In early 2006, the financial futures trading business was registered. In the same year, the Financial Futures Trading Association was added.Registered first -class financial instrument business in 2007.In 2008, the headquarters moved to Tokyo and registered the second financial instrument business in November of the same year.Registered investment proposal/institution in 2009, joined the Japan Investment Consultant Association in April of the same year.

FOREXEXCHANGE currently holds a retail foreign exchange license (regulatory number: 2010001141146) authorized by the Japan Financial Agency.

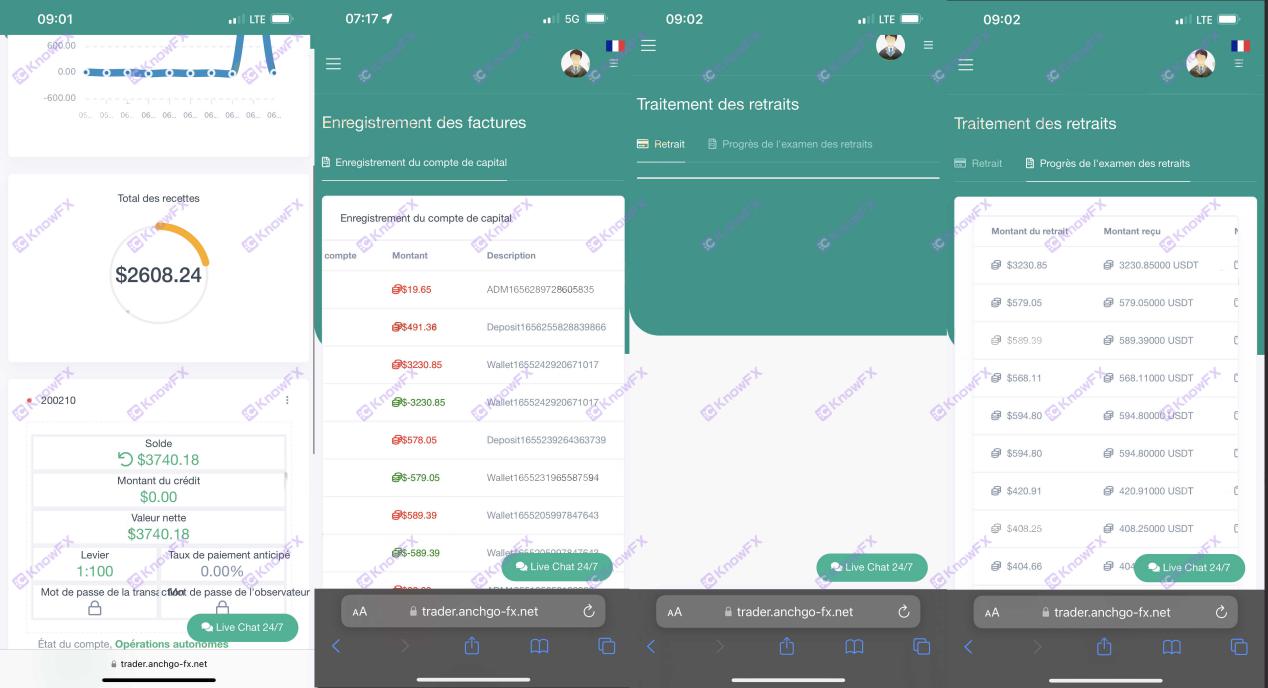

Among them, there are two exposure complaints on Forexexchange on the dealer's supervision inquiry website.

▶ Qi: System detection frozen the investor's account

According to investors: "The system freezes the investor's account, and it needs to be submitted to 20 % of the total amount to thaw. It is also called a loophole in the system and needs to be checked." This makes the investor puzzled.Run away?Intersection

▶ Second: Can't issue gold

In the exposure, investors want the platform to thaw their trading funds. The investor's account is 200210, and the account name is Terrychampagne.

Combined with the exposure complaints of the two investors, we can see that the two investors have had funds frozen during the transaction process. What is going on?

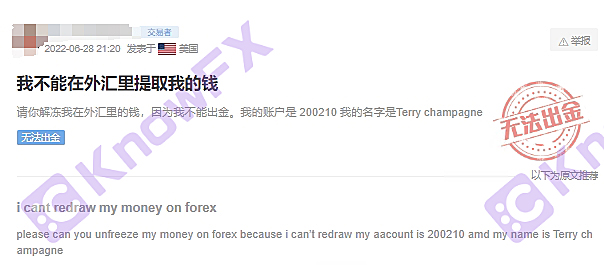

▶ MT4 is not a genuine download link of Midaq!Intersection

The truth brother downloaded the platform's MT4 through ForexexChange's official website ~

From the download grid link of MT4, ForexexChange is not a genuine download link of Midaq.

It was uploaded to their server through the official download, and everyone could not argue whether it was the main label or a white label.

Presumably, everyone is a bit doubtful here. It does not have a lot of influence on the Lord/White Bid.!!

▷ The main platform has a financial license issued by government agencies. It is supervised by local financial institutions. It must abide by relevant laws and regulations to ensure the security of customer funds and fair transactions.

▷ The white standard platform does not have its own financial license, nor is it official supervision, and can only rely on the supervision guarantee provided by the main standard platform.

If there is a problem with the main standard platform or terminate cooperation with the white standard platform, the white standard platform will face the risk of lack of supervision, and customer funds and transaction rights may not be guaranteed.

The main standards and white marks have their own advantages and disadvantages, and there are different degrees of risks.When choosing a foreign exchange platform, everyone should be carefully considered according to their needs and risks, carefully considers various factors, and make full investigations and comparisons.

On FOREXEXCHANGE's official website, you can see that the company's trading software is only MT4.

There is only one company that actually used for trading names called Forexexchangeco., LTD.

Subsequently, the truth brother searched for ForexexChangeco. Through the FSA official website of the Japan Financial Hall, LTD was regulated. As shown above, the company holds one and two -type regulatory licenses.

These institutions may include securities companies, futures companies, financial derivatives, etc., covering extensive financial transactions and settlement business.

Japan's FSA regulatory license, in the industry, is a license with extremely strict review and extremely powerful regulatory.

However, we rarely see brokers taking FSA licenses in China. There are not many overseas brokers who provide foreign exchange margin services in Japan. Therefore, this FSA license is not high for domestic everyone.

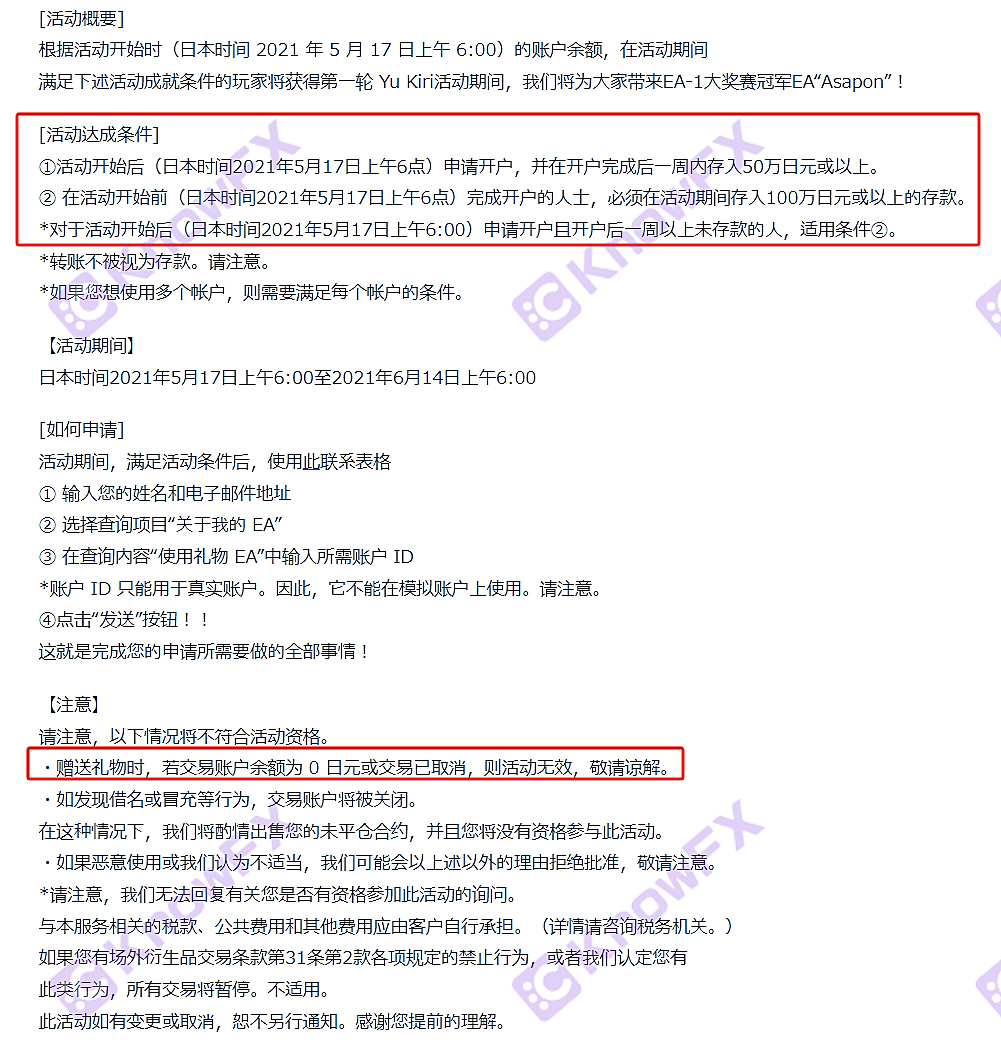

▶ Japanese brokers are not allowed to be allowed to donate money and other incentive policies ~

In order to cater to the main forces of Japanese investors, "Watanabe Mrs. Watanabe", many local brokers will use food, households, etc. as marketing gifts, and will also invite some popular stars as endorsements to attract the "Japanese housewife" group.

However, due to regulatory restrictions, Japanese brokers are not allowed to be allowed to give money and other incentive policies, so ForexexChange is obviously an unsatisfactory marketing model!Intersection

As early as 2021, someone went to the Tokyo company in ForexexChange to learn about the actual situation and arrived at the company's address. This company did have this company.

However, the exploration staff arrived upstairs. The door of the company was closed and could not enter the company to visit ~ It is unknown how the specific situation is.

summary

Let's return to the initial question: "Is it safe to do transactions in the country?"Intersection

I often see that some investors suggest that foreign exchange platforms are only credible for British and American regulations. This is a very interesting thing.Because there are very few retail operators under the United States, there are fewer business in China.However, this shows that everyone is more willing to trust this. The financial market is very mature.

American supervision is indeed nothing to say, yes!IntersectionAmerican supervision is very effective for American investors.

However, domestic investors are not necessarily. For example, in the hundreds of incidents in 2012, Chinese investors failed to recover funds.

Similar to the supervision of the FSA of the Japan Financial Hall, the Japanese FSA stipulates that the brokers are prohibited from providing services to non -national citizens.

Therefore, although the supervision of these two countries is known for its strictness, if it is in its country, it is difficult to obtain a license but have a high gold content, but if it is carried out in China, their cost performance will be very low!Intersection

Japan's foreign exchange margin market can generally be regarded as "Japanese's own market."

Japanese local retail foreign exchange dealers rarely enter the Chinese field of vision. Because the development of foreign exchange brokers in Japan is not in China, it rarely develops business in China.

I would like to remind investors that investors need to be cautious, please brighten your eyes!Intersection

You need business cooperation, please scan the code and leave the aircraft number to cooperate ~

Query platforms, complaints, more information, please understand the Hui app ~

If you need to check the platform, disclose clues, and complain, please scan the code to add the truth QQ to disclose the news !!

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

近几年,货币行业越来越热,黑平台层出不穷,披着虚假金融衍生品的资金盘...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...