Oneroyal uses a regulatory physical transaction!Injure investors to carry out ultra -high leverage to earn a difference!

Oneroyal

Oneroyal is a financial product broker in the global exhibition industry.Established in 2006, he claimed to have the top technical team, and can provide careful integration solutions for all customers regardless of the scale and type of transaction.

It is worth mentioning that oneroyal holds Australian ASIC license!However, affected by the 2019 Australia's financial supervision upgrade and my country's strict control over financial foreign exchange, the entity of Australia's ASIC regulatory release no longer serves Chinese customer information!

There are many platforms in China so they think that Oneroyal no longer operates the Chinese market!But this is wrong! In fact, except for the entity under the Australian ASIC supervision, it is accepting investment and transactions from Chinese customers!After all, you can still see the "active" user of Oneeroyal on some third -party platforms.

Regulatory information

ROYALFINANCIADRADINGPTYLTD

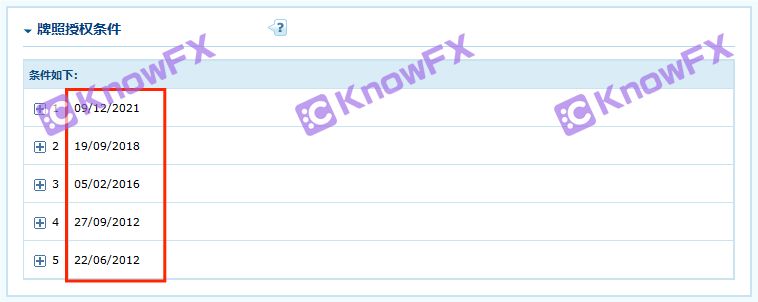

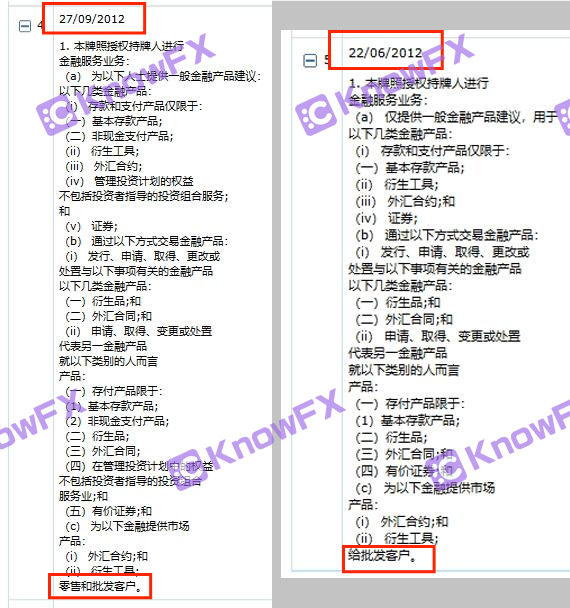

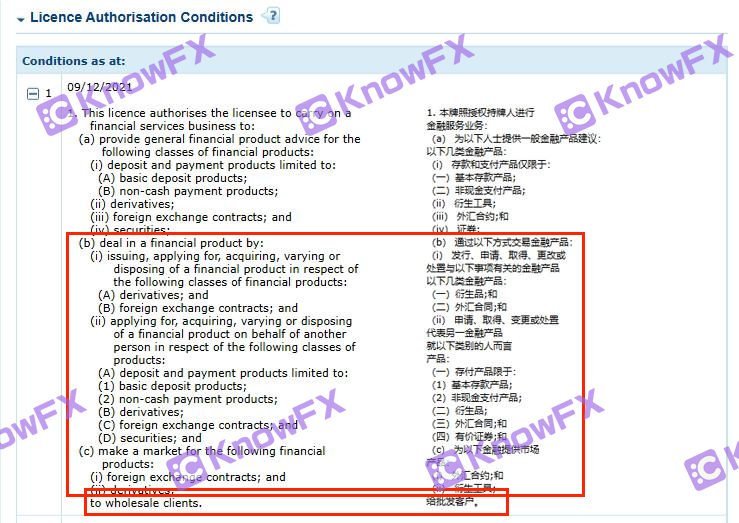

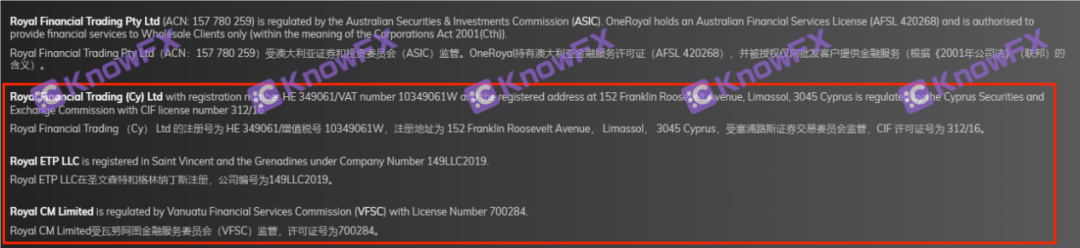

At the same time, I know that I find that oneroyal's ASIC regulatory company RoyalfinanCialTrandingptyltd has multiple more licensed information information!

It is worth noting that from September 2012 to September 2021, the company has always provided a wide range of trading business scope and can be operated for retail!

but!On the recent December 2021, Oneeroyal has changed the Australian ASIC license again.After changing, this license still provides a wider range of trading operations, but it has lost the right to serve the retail ends!

Therefore, I know Brother Special Reminder!At present, even if you can invest in Australia, you should take the initiative to avoid the company's entity!

In addition, oneroyal's official website states that there are three companies that have three companies and are subject to supervision:

RoyaletPllcc

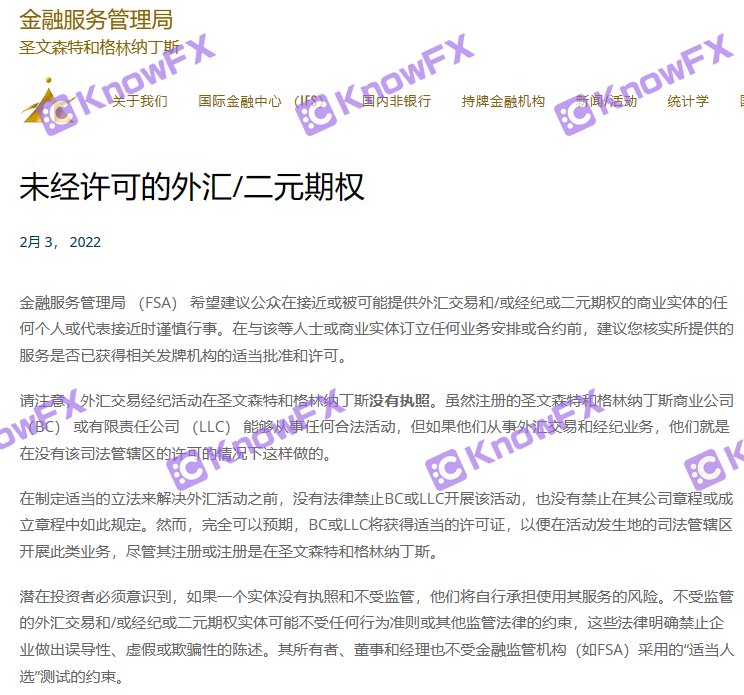

The RoyaletPllc, which is regulated by the San Wendans Financial Services Administration FSA, does not have to say more!Knowing that Brother has mentioned many times that San Vincent FSA is a offshore supervision, and the financial and regulatory system is relatively backward.And it does not regulate foreign exchange, binary options and digital cryptocurrency -related transactions.

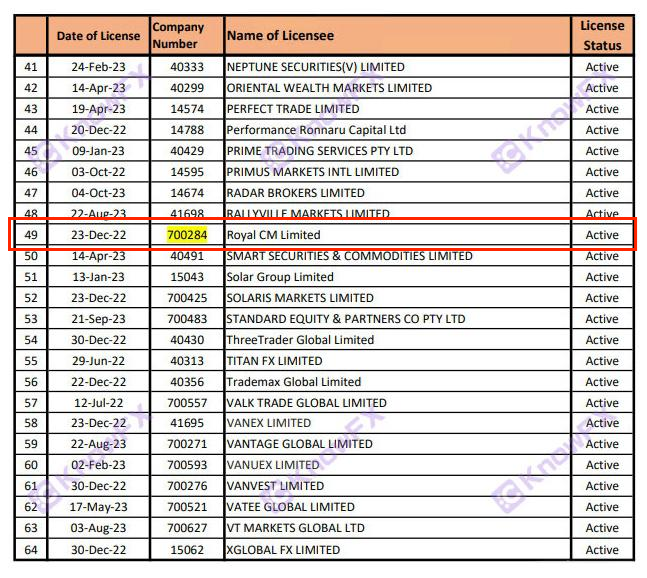

Royalcmlimited

Royalcmlimited, a company's company, holds a license by VFSC by Vanuatu Financial Service Committee.Vanuatu VFSC is also offshore supervision!Such regulatory approval procedures are often less, the business licenses are issued fast, and funding is hidden.Some do not even need to have corresponding qualifications and local office staff, you only need to pay for everything to talk about.

As a result, when the foreign exchange regulatory platform in these areas damages the customer's rights and interests, it is basically impossible to maintain.Therefore, when you choose to use San Wendente FSA or Vanuatu VFSC platforms such as offshore supervision to conduct business exchanges with the agency, it is recommended to understand relevant laws and regulations and risks, and carefully evaluate the risks and interests of cooperation with the agency.

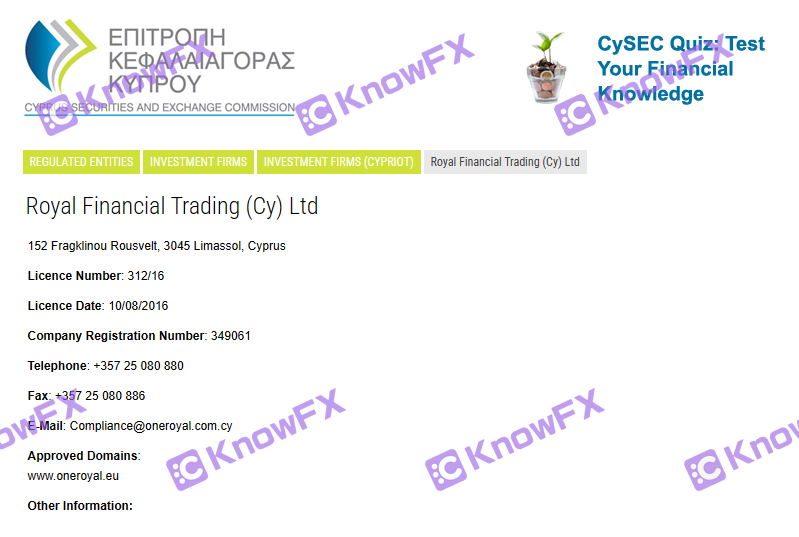

ROYALFINCIALTRADING (CY) LTD

As for RoyalfinanCialtrading (Cy) LTD, this company is indeed supervised by CYSEC supervision by the Cyprus Securities Exchange Commission!At the same time, it has been awarded a more comprehensive transaction investment service and auxiliary services!

However, CYSEC in Cyprus mainly serves European and surrounding markets.If a broker wants to serve Chinese investors, it needs to apply for it!But it is obvious that among the members of the cross -border service column, there is no country in China!Therefore, it can be determined that once the account of Chinese customers is opened in this company, there is no guarantee!Everyone should pay attention!

Trading platform

However, regulatory information is just the beginning!Then let's take a look at the MT4 and MT5 platforms used by Oneroyal for transactions!

MT5

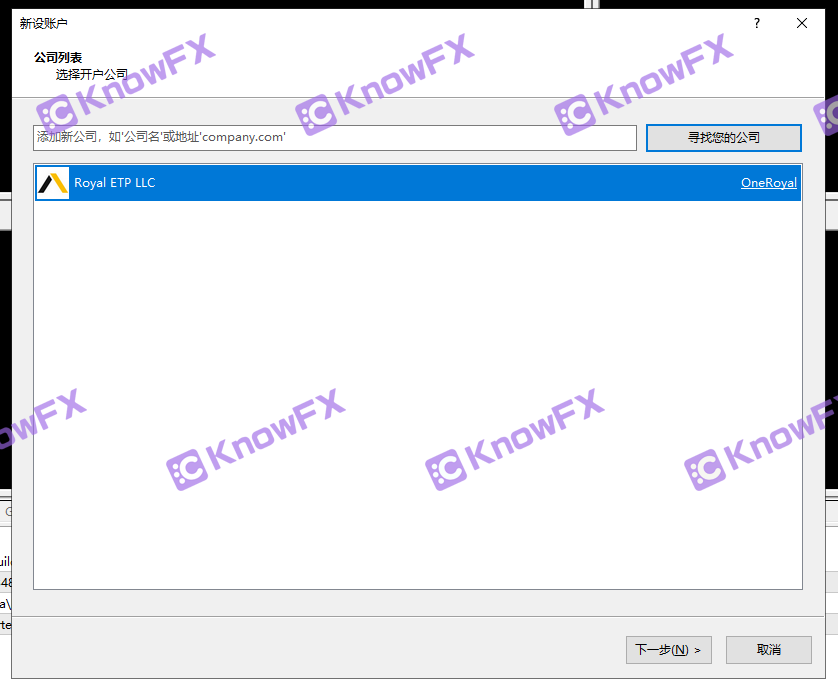

The first is the MT5 platform!As shown in the figure, oneroyal is registered and traded with RoyaletPllc, a St. Vincent FSA entity!This means that the transactions of foreign exchange, binary options and digital cryptocurrencies through its MT5 platform are not subject to supervision and protection. Obviously it is to avoid supervision!

MT4

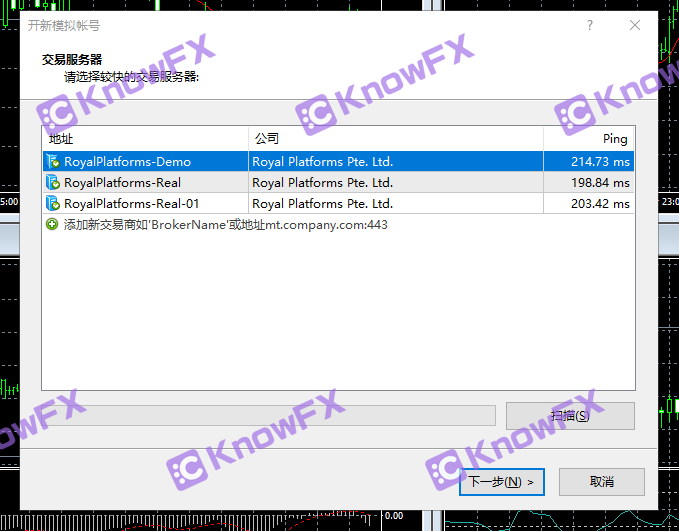

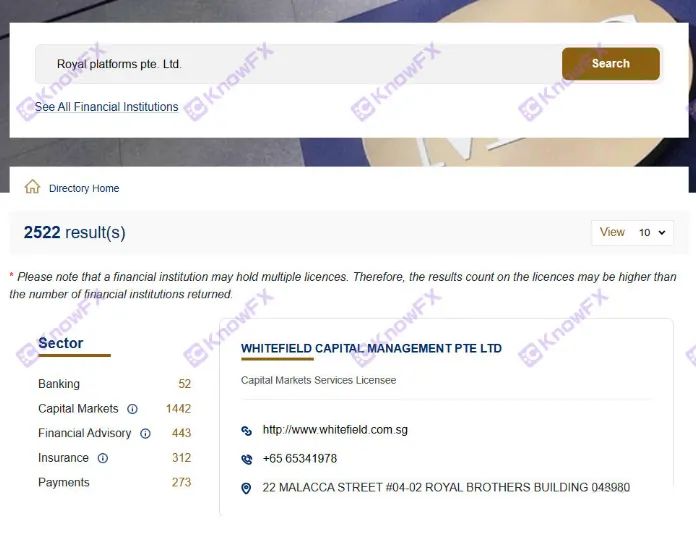

Oneroyal simply uses a Singapore company RoyalplatformSPte.ltd. Register and transaction directly using a Singapore company that cannot be verified on its official website!

What is even more angry is RoyalplatformsPte.ltd. This Singaporean company knows that Brother Ge cannot find relevant regulatory information at the Singapore Financial Administration MAS!This shows that the company is absolutely not regulated in Singapore. At the same time, it can be seen that the transaction through its MT4 platform is running naked, and it is not subject to any supervision!

Thousands of leverage and gold -gift activities

Knowing that Brother also pays attention to ONEROYAL also offers up to thousands of times of leverage!You must know that the leverage has enlarged the investment income, but also increases investment risks.This is essentially a gambler's behavior!It may cause investors to withstand losses and generate high debt.

At present, the world -class regulatory agencies are committed to being very rare to maintain the stability and healthy operation of the financial market by restricting high leverage!And this thousand -twice leverage with ONEROYAL's credit donation activity has attracted a high degree of vigilance of understanding Brother!

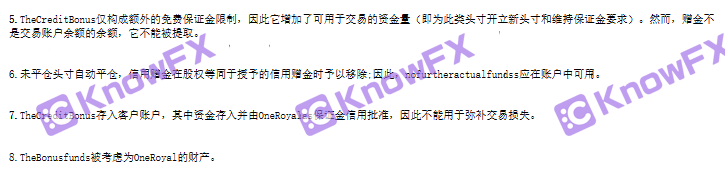

Oneroyal said that 1: 1 provides "credit gifts", but the "donation" is neither an account balance nor extracted, and it cannot be used to make up for account losses!It can only be used for transactions!

What does it mean?You can understand that this is a kind of lending investment!In essence, ONEROYAL pushes high leverage again in the name of "Gift"!

However, this is just a superficial!If you put all the "gifts" and the principal into the transaction, then you are paying double the difference between each transaction; at the same time, "Gift" does not belong to the account balance, but the money invested in the market is doubled, which is this that it is more than doubled.It means that you have more than double the possibility of liquidation!Then look at this leverage up to 1000 times!

Is it wonderful?As long as you are willing, you can trade with a leveraged risk of 2,000 times!And oneroyal can eat two times the difference without doing anything!Who is this benefit?

Summarize

First of all, ONEROYAL did not withdraw from the Chinese market!But the entity it used for transactions is not subject to supervision!Through thousands of leverage and "Gift" activities full of thoughts, it is unyielding to investors to carry out ultra -high leverage to earn high -amount differences.

Finally, if you need to check the platform, disclose clues, and complain, please scan the code to add an detective QQ to make the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui app

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

近几年,货币行业越来越热,黑平台层出不穷,披着虚假金融衍生品的资金盘...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...