What is the liquidity solution provider?By analyzing Tinytrader, take you to understand!

Tinytrader Introduction

Our protagonist Tinytrader is different from our past. It is not a broker, but a universal derivative technology and liquidity solution provider.

Its main function is to use new technologies to support the projects of traditional finance, difference contract brokerage companies, fintech companies, and encryption programs to enhance their business capabilities.

And on the WikiFinanceExpo on November 16 this year, he took partner Coinw as a sponsor!This makes it particularly eye -catching in this exhibition dominated by securities firms, and it also proves its strength and ambitions from the side!

Specific business

"Liquidity Solution" is a big proposition, which mainly includes the following four aspects:

Main business service: Play the role of a city merchant in order to provide the price that both can accept both buyers and sellers, and provide liquidity support for market participants.

Liquidity aggregation: Integrate liquidity from multiple markets and exchanges, provide customers with wider market access, and provide efficient liquidity through technical means.

Liquidity supply: Provide market participants with liquidity, including providing quotations, providing market depth, providing transaction opponents, etc. to support their trading activities.

Technology and infrastructure support: Provide customers with technical support such as trading platforms, trading systems, data analysis tools to help them achieve more efficient transactions and liquidity management.

Tinytrader is obviously the fourth category. Providing technical support for trading platforms, systems and analysis tools for securities firms is its main business.

There are two main services for such providers:

One is to help securities companies better access third -party platforms, such as MT4, MT5 or Trader.

Second, it is to build a new platform directly for securities firms, that is, to understand the "self -developed platform" that Brother often said.

There will be questions about Huiyou, obviously Tinytrader is a third -party platform!How can you become a "self -developed platform" of a broker!IntersectionYou can see one or two on the terms of the use of Tinytrader's official website:

You can see that Tinytrader took himself out of the operating terminal of its R & D platform early in its clauses!And do not assume any responsibility for any non -personal assets and data on the platform!

Therefore, the essence of the trading platform for its research and development is still completely controlled by securities firms.And all risks of the existence of the "self -developed platform"!

Outrageous clause

If the above clauses are just Tinytrader's business mode, it has nothing to do with the right or wrong, then the following terms are rogue!

For example, "We reserve our own decision to publish a revised version on the website to modify the rights of these use terms." Then, "The revised clause will take effect after the release." And after the modification, Tinytrader will not notify the customer and ask customers to say that they will say that they will say that"You have a responsibility to check this website regularly to understand the modification of these terms of use."

Although our vast number of Hui friends are not the direct customers of Tinytrader, I still can't help but talk about my brother!

Tinytrader partner

Then let's take a look at what partners in Tinytrader!

If you look closely, you can find that the "broker" that cooperates with Tinytrader, no!To be precise, it should be called a dealer!Because Tinytrader serves not the securities firms in our common traditional markets, but "emerging" dealers used to serve cryptocurrencies.

Obviously, the "emerging" market financial world of cryptocurrency is obviously not ready to accept it!Therefore, its supervision is quite chaotic, and there are great differences in various countries and regions!For example, my country directly does not recognize its legitimacy; the United States CFTC is considered a commodity and supervised the cryptocurrency derivative market; the British FCA is only responsible for supervising the behavior of cryptocurrency companies in the UK!

This also caused the platform supervision to focus on "cryptocurrencies" was extremely chaotic, and it was not even under supervision at all!

Coinw

Such as a secret currency dealer Coinw!Not only do you sponsor Wikifinanceexpo with Tinytrader; you can also sponsor the Global Football Award with Tiktok!However, cryptocurrency dealers with such financial resources!I can't find a little related regulatory information!It can be seen that it is outrageous.

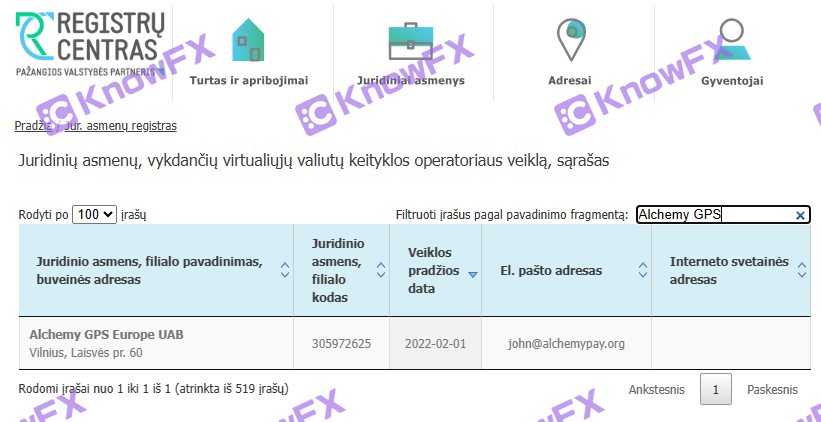

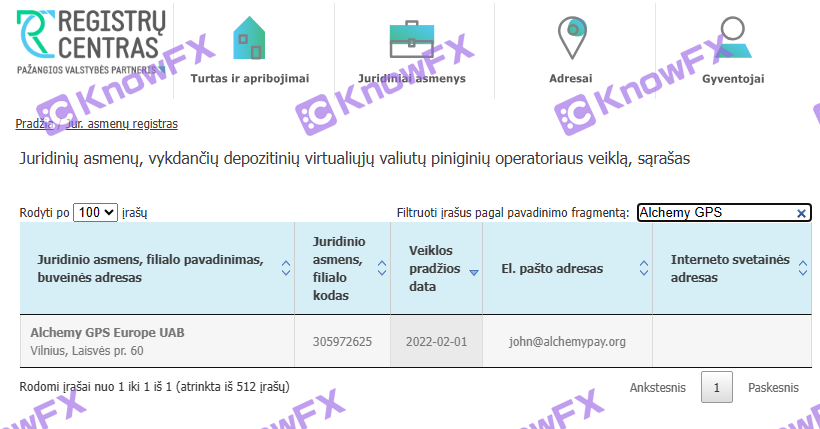

Alchemypay

Of course, it is not that cryptocurrency dealers in cooperation between Tinytrader are not regulated!For example, Alchemypay is awarded the virtual asset service provider issued by the Lithuanian Financial Crime Investigation Bureau FCIS!

In addition, Lithuania FCIS has two encrypted licenses, and Alchemypay is held!

One: cryptocurrency exchange license CryptocurrencyExchangelicense

Lithuania's cryptocurring license covers services to exchange fiat currency into cryptocurrency, cryptocurrencies into fiat currencies, and cryptocurrencies into cryptocurrencies, which is suitable for cryptocurrency exchanges.

Second: CryptowalletandCustodiansLicEsLicEsLicEsLicEsLicEnsLicense Wallet Service for encrypted wallets and hosting service licenses refer to the service for customers to generate key or preserve customers' encryption keys in their procedures, which can be used to save, store and transfer virtual currencies.

In addition, it is worth mentioning that the main financial regulatory agency of Lithuania is LBE LBE!Lithuania FCIS is a law enforcement agency responsible for supervision and investigation of financial crimes.Of course, I know that Brother is not emphasizing the supervision of Lithuania's FCIS, but wants to tell everyone that the cryptocurrency chaos and embarrassing situations are currently!

Tinytrader's supervision

Speaking of supervision, we look back at Tinytrade!It is obviously not financial -related supervision as a liquidity provider providing a trading platform!But on its official website, we can see that Tinytrade claims to obtain ISO27001 information security management system certification!

This certification is the recognition and proof of independent third -party institutions through the ISO organization to prove that its information security management system has met international standards and can effectively protect its information assets!But it only has certain regulatory significance!

At the same time, Tinytrade only explained the certification and did not provide corresponding certification information!It is necessary to know that the certification is different from financial supervision. The object targeted is the information security management system of the entire organization, including the organization's policies, processes, procedures, personnel, and technical control.Tinytrade does not determine the validity of its certification without providing relevant information!

Summarize

Today's introduction to Tinytrade is mainly what Tinytrade has helped Hui friends the "liquidity solution provider" provided.At the same time, let everyone know what kind of platforms will be classified as "self -developed platforms".At the same time, it is also used to understand the chaotic regulatory environment under the prosperity of cryptocurrencies!I hope that today's content can help the friends!

Finally, if you need to check the platform, disclose clues, and complain, please scan the code to add an detective QQ to make the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui app

Know brother: 2124228721 Detective: 3464399446

Truth: 3147677259 Poisonous tongue: 2389671330

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

近几年,货币行业越来越热,黑平台层出不穷,披着虚假金融衍生品的资金盘...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...