Recently, there have been many outrageous things. There is no lower limit on the operation of some problem platforms. I refresh the three views of my brother again and again. Let ’s take a look today. These operations are outrageous platforms!

1.vistova

Many dishonest trading agencies or individuals use investors' desire for high returns to attract them to join the so -called "recommended stock exchange group" or "stock learning group" through false propaganda or fraud.

These groups usually promise to provide inside information strategies or advanced technical analysis of making money, but they are often to deceive investors' money or personal information.

This platform Vistova uses this way!Intersection

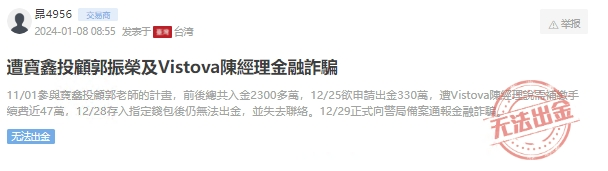

Investor exposure feedback: "On November 1st, he participated in the plan of Mr. Guo, the Mr. Guo Investment Counseling, and a total of more than 23 million yuan was incorporated. On December 25, he wanted to apply for 3.3 million yuan.On the 29th, the Police Department filed to report that the platform has financial fraud. "

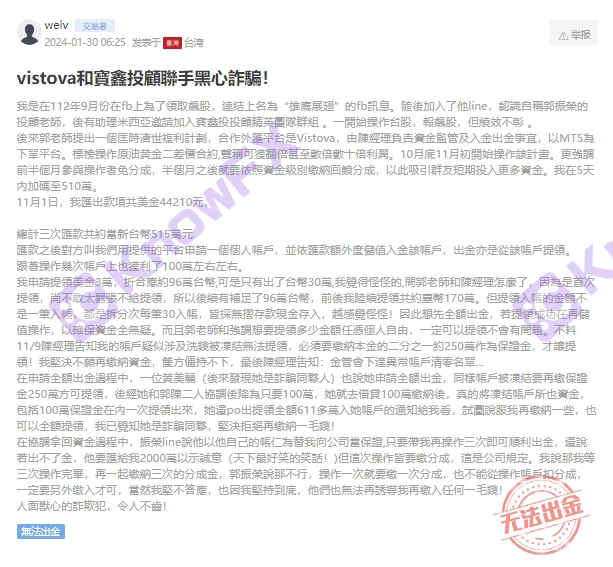

Vistova and Baoxin Investment Consulting joined forces with black heart fraud!

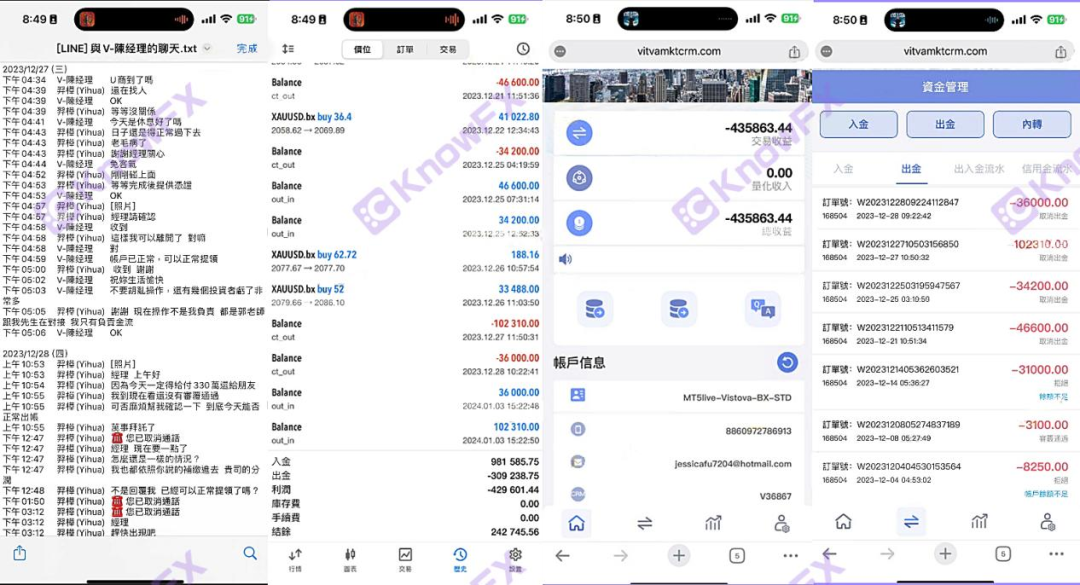

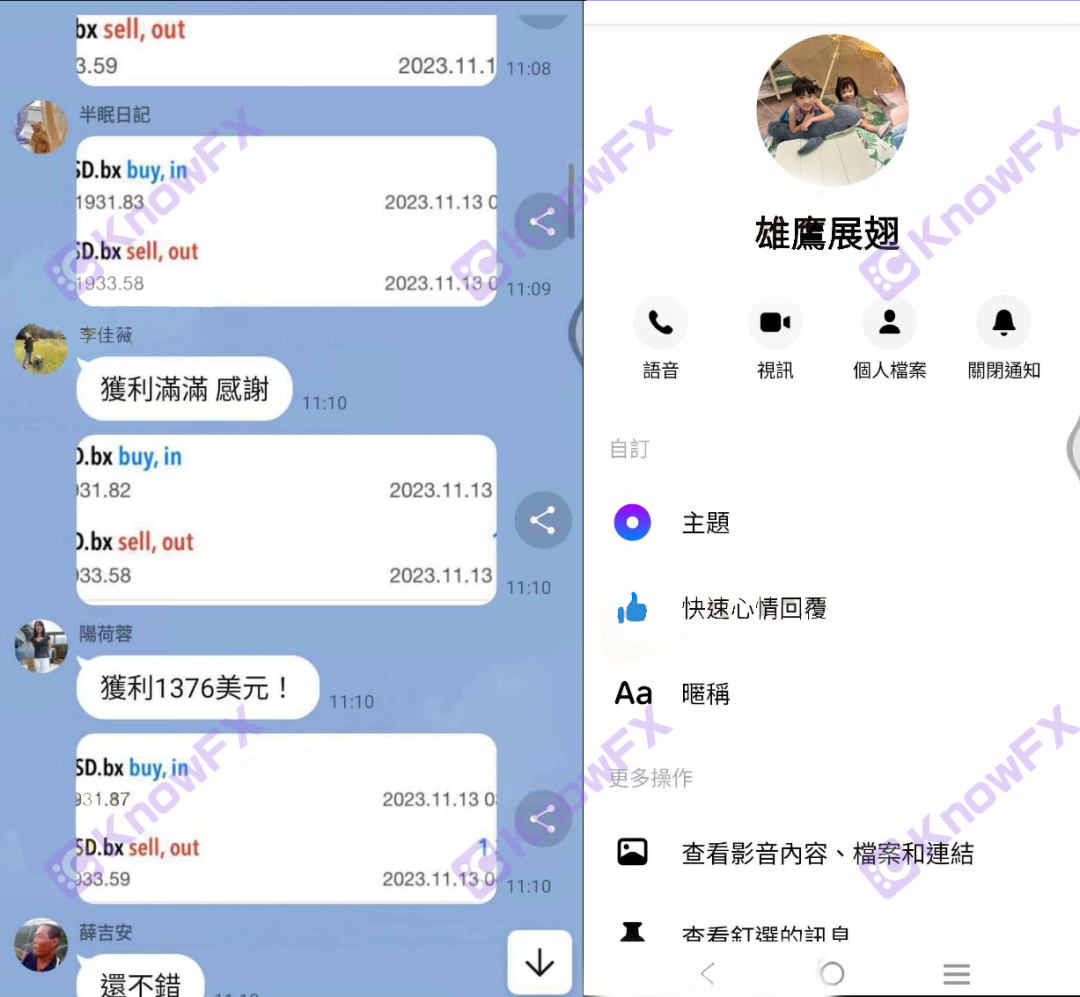

Exposure of self -reporting: I learned a "soaring shares" event through Facebook in September 2023, added from this event to Facebook called "Eagle Show Wings", and left contact information with each other.The investment adviser named "Guo Zhenrong" was later pulled into an investment group called "Baoxin Investment Guideline Team". There are special teachers in the group to teach how to operate stocks to earn more profit.And still recommend stocks.

Soon, this Teacher Guo proposed an investment activity in the group. The cooperation platform was Vistova, a foreign exchange platform, and Manager Chen, the investment manager of Vistova, was responsible for managing investors to enter and exit money.

Because I saw so much profit, the investors enabled 5.1 million Taiwan dollars within 5 days.

The subsequent withdrawal was rejected. At first, "the first application for funding was issued and did not meet the full profit standards, so you could only apply for a small amount of gold many times."

In the case of investors, they have applied for deposit several times, but the amount of the application cannot be received at once!Intersection

At this time, the investor was doubtful, and he chose to pay all the money at one time!Intersection

As a result, Manager Chen of Vistova said that his Vistova account was suspected of money laundering and was frozen and could not be issued. It had to pay 50%of the principal as a deposit, that is, 2.5 million, to thaw to continue applying for money.

2.Dooprime Dexuan

As for the "scandal of the boss Chen" and "overseas rights protection" incidents, it was exposed as early as many large -scale information platforms at home and abroad!Because the detective could not confirm the authenticity of the facts, he briefly stated to inform Hui You and made it to his own judgment. What sin is?

In addition, some investors have discovered problems such as DOPRIME Dexu Platforms, abnormal changes in the net value of accounts, and unable to display the balance after deposit in time.At the same time, the platform tried to attract investors to become agents, and proposed to adjust the point difference to get high commission.

There may be investment that this may be that this may be faked in Dooprime, but the detective tells you more than one case!

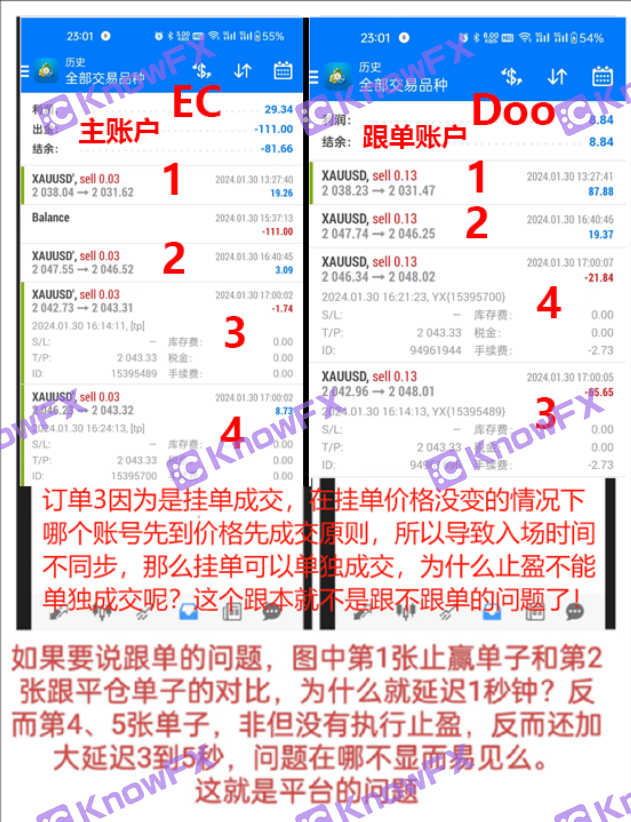

The investor followed the order on the same VPS.This excludes the possibility of delay, so the implementation of a single account should be consistent.

However, as shown in the figure, other accounts and single accounts played according to the main signal account, but the DOO account did not perform the appearance of the stop profit at accordance with expected.doubt.

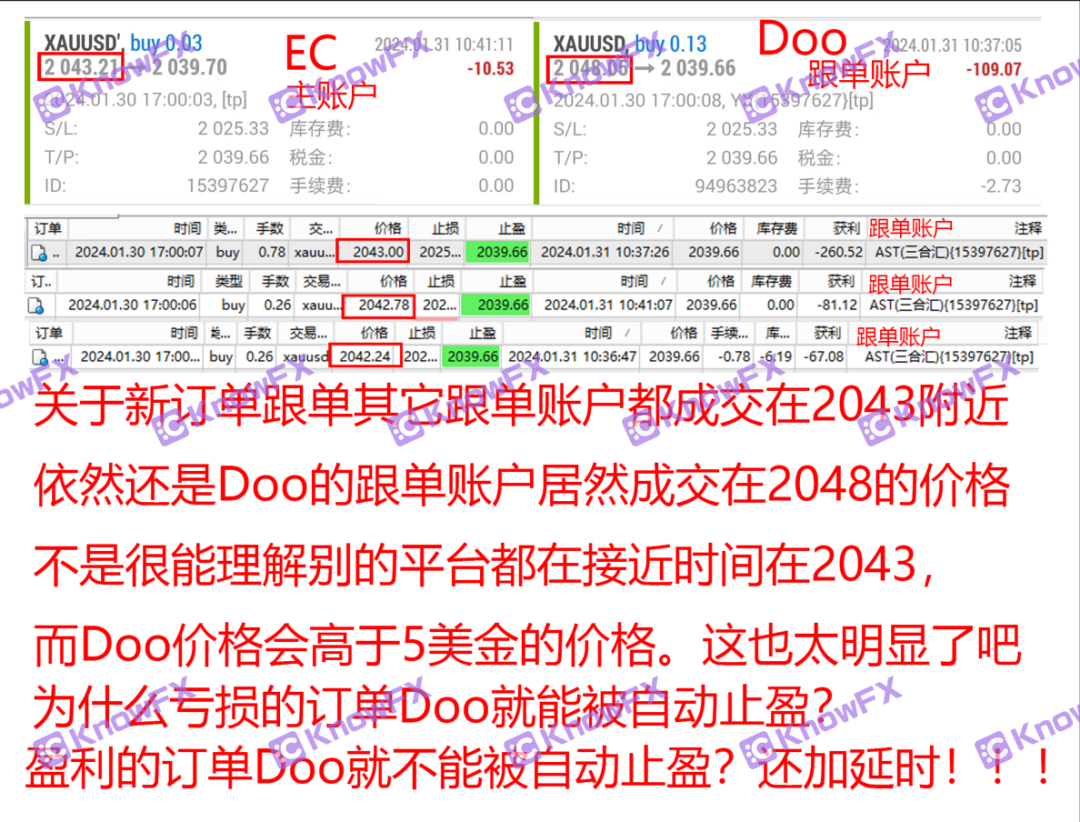

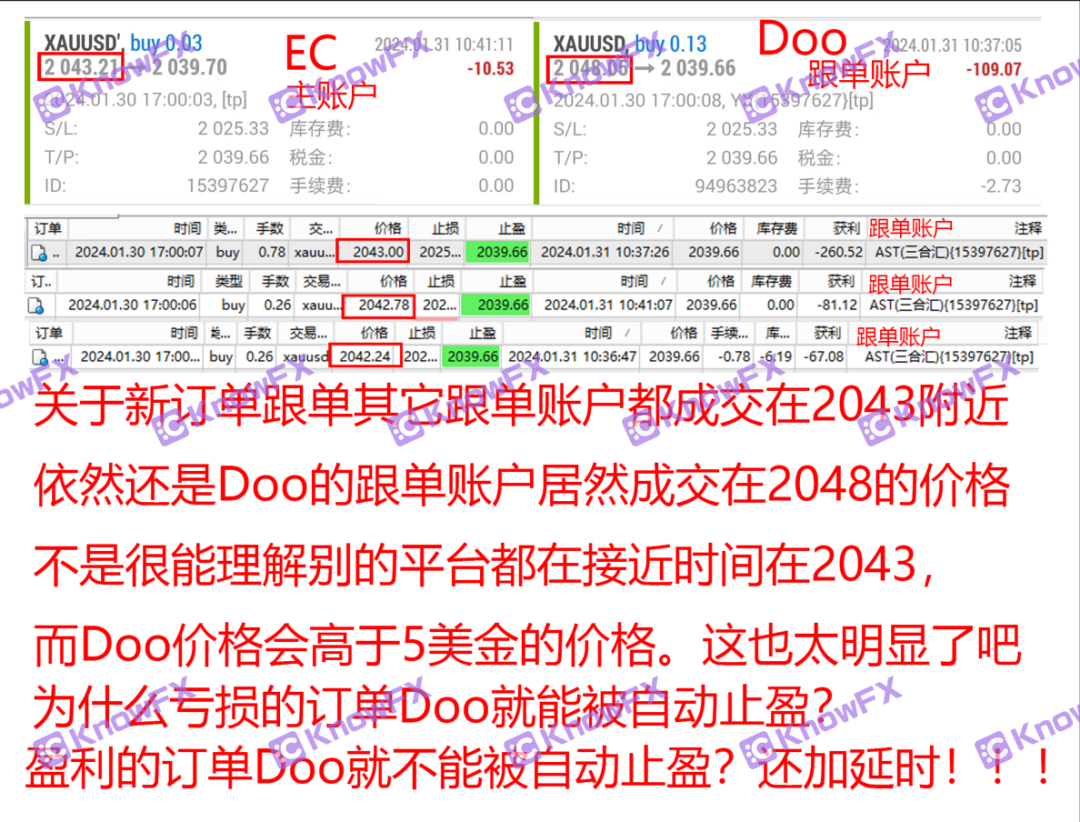

For this reason, investors open a new position on the same VPS.However, other accounts followed the price of around 2043. Only the DOO account is unique to the price of 2048? Is this the DOO account delayed by the malicious risk control?

Soon after, such incidents happened again. Similarly, other platforms and single accounts could be lined normally. Why did the account give delay to liquid and liquidate instead of the account actively stopping profit?Is it accidental that similar things happened one after another?

So the investor contacted Dooprime Dexuan, but he did not provide a clear interpretation and solution for investors' questions and concerns!And simply push the responsibility to the difference from the single platform.

These outrageous platforms have a commonality, that is, after the problem, there is no way to solve it well and also requires continuing the funds of investors!Everyone must pay attention to these two platforms!Intersection

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

近几年,货币行业越来越热,黑平台层出不穷,披着虚假金融衍生品的资金盘...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...