AUSGLOBAL's 100,000 investors involved 220 million, wouldn't there be anyone dare to enter the gold?

"Australia" illegal "fried futures" case

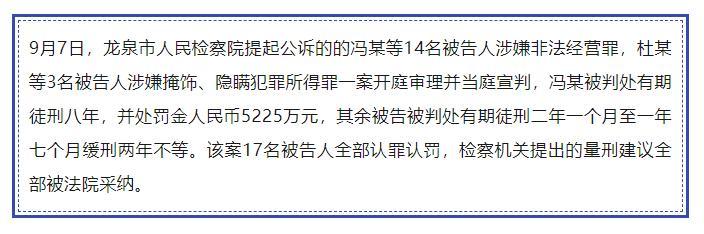

Speaking of Xinhui, I have to mention the case value of 220 million "Australian Hui" illegal "fried futures" in the case of public prosecution in Longquan City.

The fourth -party illegal settlement payment channel set up by the gang provides customer entry and fund settlement services for a ASEAC Futures Platform, helping the platform to avoid public security organs to crack down, and transferred more than 70 million customers' funds.At the same time, a large number of private accounts are also borrowed for settlement.Most of the profits "washed" through his ex -wife Du and his relatives and friends accounts.According to statistics from the incident, the amount of illegal futures transactions on the Australian exchange platform reached 220 million yuan.

However, due to the illegal operations that were strictly prohibited by the state, this case caused widespread attention and eventually became a major case in the supervision of the Ministry of Public Security.

Looking at the case, the referee documents mentioned:

Customers can buy and sell directly on the platform, without the need to review, and also set up a maximum 400 times leverage.

Promoting the platform's long -established time, formal licensed licenses, low investment and high return to attract customers.

Developing the IB system, old customers can develop new customers after becoming a platform agent.

Collect customer information data, training companies, and train customers for free.

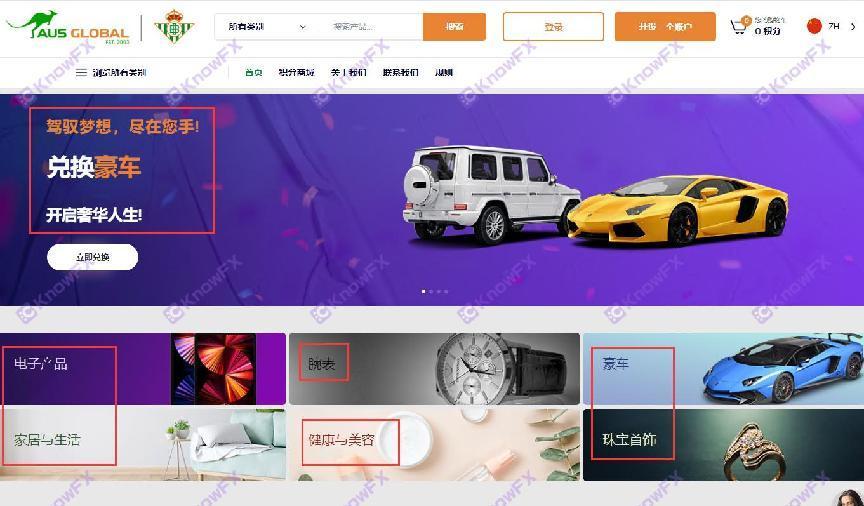

We know that AUSGLOBAL's predecessor was AUSFOREX. On the surface, it was "big replacement" after "reorganization and equity changes".Tibet continued to deceive.

Moreover, "long establishment", "have regular licenses with foreign countries", "low investment and high return", "old customers can develop new customers after becoming agent" including the current official website of Ausglobal's rolls.They are all means to attract customers.

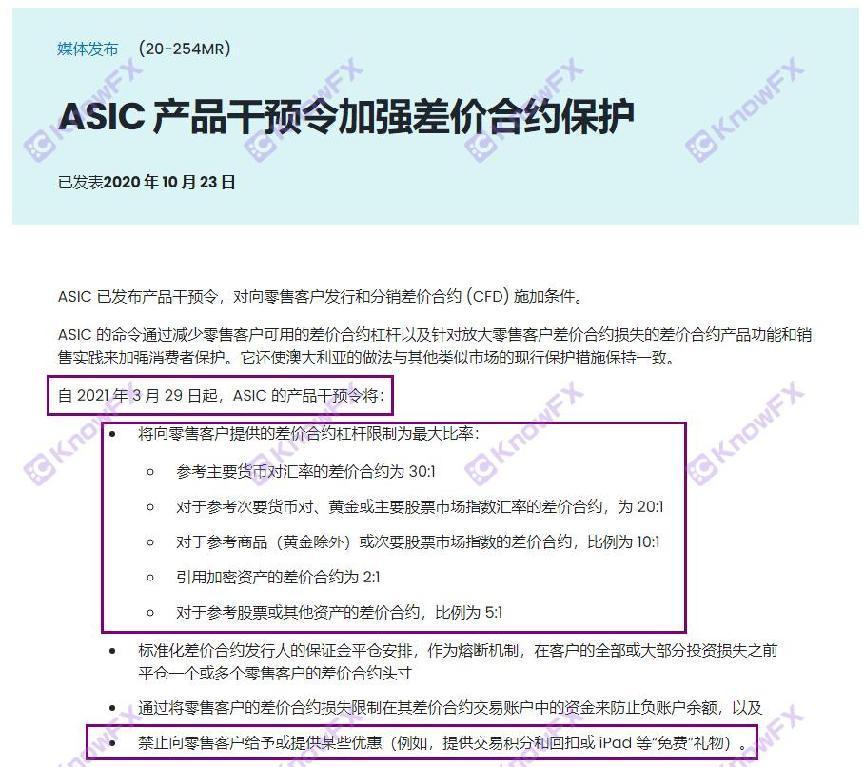

In 21 years, the case value of 220 million "Australian" case of 220 million "Australian Futures" cases of "Australian Hui" confession law confession was confession.It is forbidden in China. Similarly, the ASIC product intervention order has strict restrictions on the leverage ratio, and the maximum does not exceed 1:30.The Australian ASIC license has a high amount of gold content, and Australia's Australian ASIC licenses that have proved to be active have not participated in the transaction, but they are just a vase named "Foreign Regular Supervision License".

While talking about Australia ASIC and many countries, Australia will once again increase leveraged multiple to 1: 500!It can be said that the judgment of the People's Procuratorate completely warned that it seems that the 220 million funds of 220 million investors have been swallowed by Australia.

Poison Tongue Jun checked the Customer Agreement of Australia, and "very intimate" attached simplified Chinese.Although the Chinese official website is pop-up, the content of the Chinese official website indicates that the mainland Hong Kong is not in its judicial jurisdiction.Chinese people are still the main goal of Australia's gathering funds.

"The terms and regulations of this customer agreement constitute the contract terms between AUSGLOBALLLIMITED." In short, [AusglobalImited.] Will become the trader of the agreement, and your account will be existed with the [AusglobalLimity.]Real transactions occur in the entity.

Continue to read, Australia's long -term emphasis emphasizes the overlord clauses for customers.

"For reasonable reasons, AUSGLOBAL will change and suspend all services at any time. If you cannot tell you, AUSGLOBAL reserves the right to not bear any responsibility." The clause is almost completely biased towards the self -protection of Australia, and all services can be changed at any time.What is it?Then there is a big problem with this "reasonable reason"!

The transaction pays attention to fairness. Since the platform enjoys the power to change and stop service at will, the platform must be legally operated!

Australia's trading platform does not even have MT4/MT5, only AUSGLOBALCTRADER.

Obviously, it is clear that it is a big securities firm that is the main standard of MT4/MT5. Why is there no trading platform for MT4/MT5?The CTRADER plug -in is flooding, and the PAMM with a single system is extremely unstable. The transaction execution of the fund manager may also have delayed or slippery points that cause the investment results to be inconsistent.After "technical failure", the loss of funds.There may be insufficient liquidity in the foreign exchange market, which will also lead to difficulty in transaction execution!

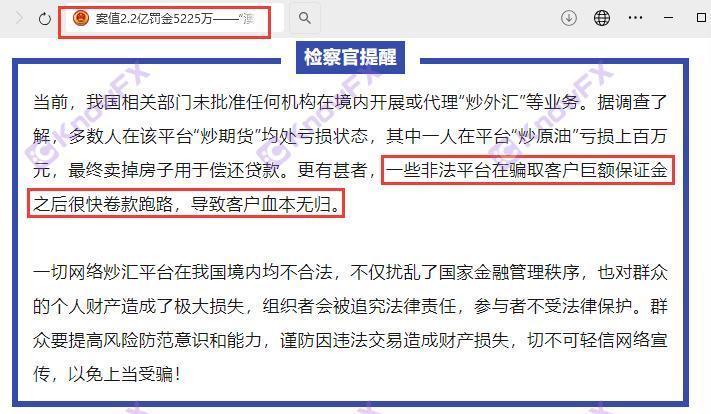

Finally, the prosecutor of the illegal "fried futures" case of Australia reminds investors that there are many ways to deceive the huge deposit. Do not be attracted by "pies" such as luxury cars.Instead, the fund itself is also his purpose. The fund disk will do everything possible to avoid supervision, and gather the investor's funds roll runner!In the event of abnormal platforms such as Australia, the supervision is abnormal, and the promotion of the prime minister's points is increased!Detective suggestions far away!If you need to check the platform, disclose clues, complain

Please scan the code to add QQ!

Exchange Circle Detective: 3464399446

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platform, complaints, more information, please understand the coding app to understand the remittance app

Or major application markets and mobile store search

Keyword "To understand" download

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

近几年,货币行业越来越热,黑平台层出不穷,披着虚假金融衍生品的资金盘...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...